In Insurance Policies the Insured Is Not Legally

The insured person is a primary subject in a life insurance contract written between the owner and the life insurance company on the life of the insured person. Thus insurable interest must exist between the applicant and the individual being insured.

Auto Insurance Card Template Pdf Lovely Template Of Insurance Card 13 Precautions You Must Take Car Insurance Card Template Free Printable Card Templates

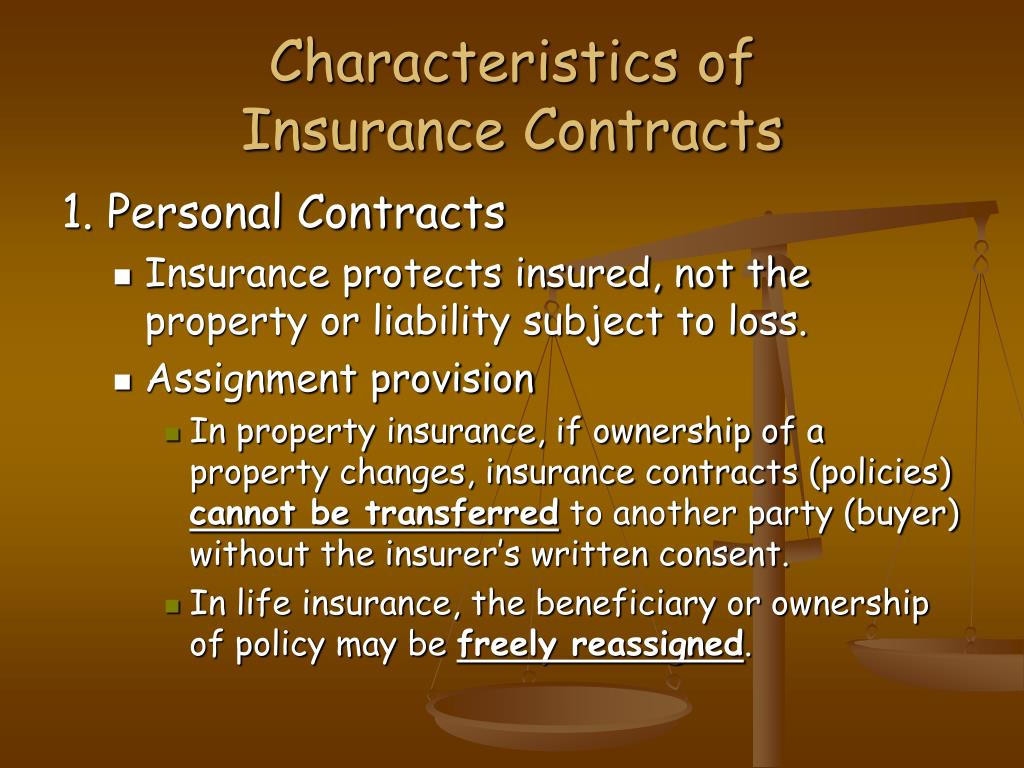

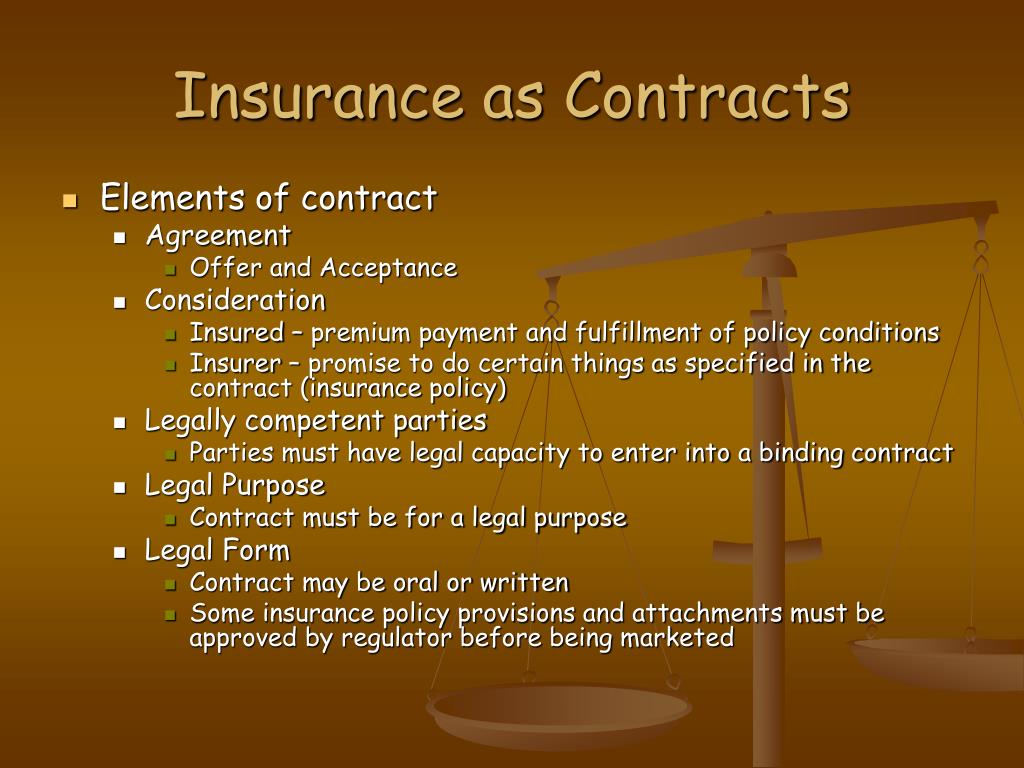

In insurance the insurance policy is a contract between the insurer and the policyholder which determines the claims which the insurer is legally required to pay.

. According to the US. Workers compensation insurance provides financial assistance to injured employees and coverage for legal expenses when employees sue a business owner over a work-related injury. An insurance policy is a legal contract between the insurance company the insurer and the person s business or entity being insured the insured.

When an insured person dies the life insurance company is bound to pay a death claim to the beneficiaries. The insured argued that the issue of whether it actually paid was irrelevant under a liability policy obligating the insurer to pay when. This policy is referred to as professional liability insurance for some professions.

In exchange for an initial payment known as the premium the insurer promises to pay for loss caused by perils covered under the policy language. A policy obtained by a person not having an insurable interest in the insured is not valid and cannot be enforced. Claim was attempted 5 months after an insured got cancelled due to nonpayment and is.

What contract element does this describe. This is one of the most fundamental concepts relating to life insurance. Legally life insurance is a contract governed principally by state law.

This is because an insurance policy is an a. What contract elements does this describe. The courts will normally interpret a policy in favor of the insured when the meaning of the policy is not clear.

The carrier argued that since the settlement agreement obligated entities other than the insuredincluding the paying agentto issue payment on the insureds behalf the insured never paid or became legally obligated to pay. Insurance contracts are designed to meet specific needs and thus. This meant that states had the power to regulate the business of insurance.

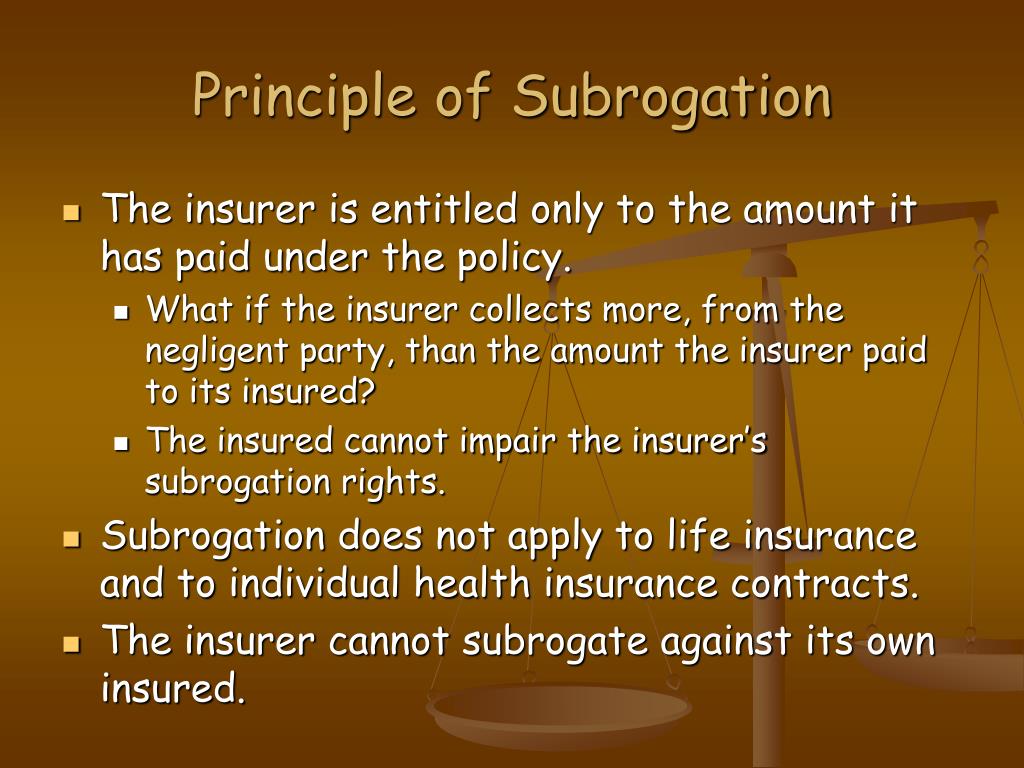

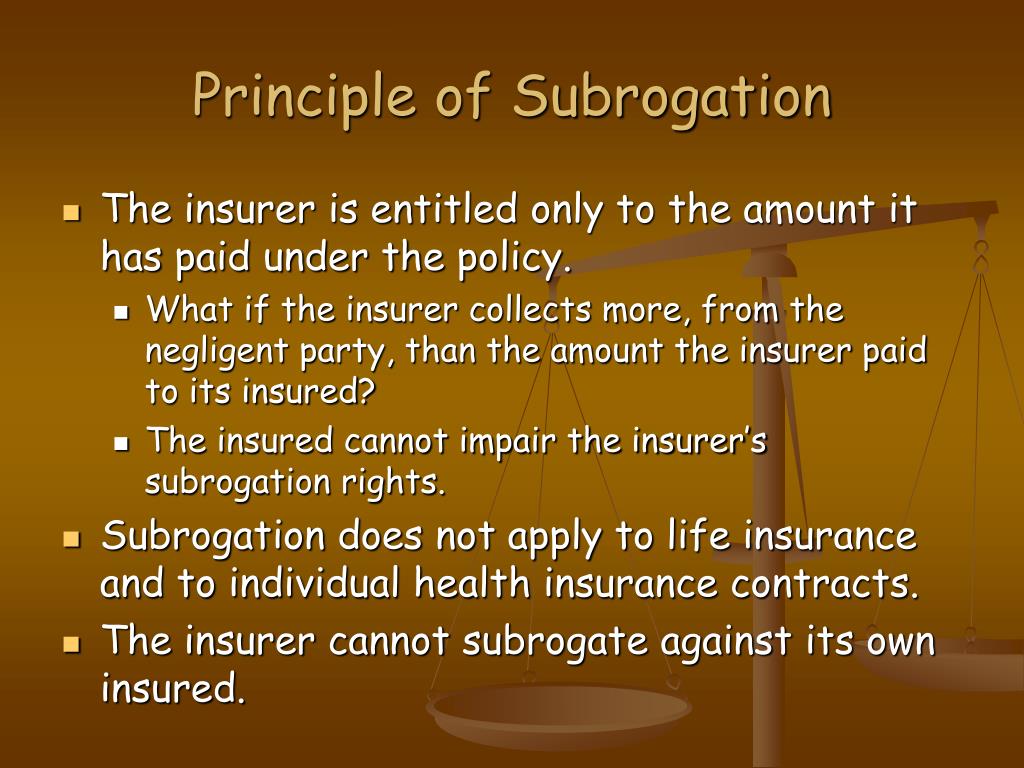

The Illinois Insurance Code section 215 ILCS 5143a1 provides. In insurance policies the insured is not legally bound to any particular action in the insurance contract but the insurer is legally obligated to pay losses covered by the policy. The insured in a policy is not limited to the insured named in the policy but applies to anyone who is insured under the policy.

The promise or assurance of the representation. Aleks 24 1 year ago 6 0 Unilateral is the contract element described here. In insurance policies the insured is not legally bound to any particular action in the insurance contract but the insurer is legally obligated to pay losses covered by the policy.

The insured is the. The driver made a claim under his car insurance policy for uninsured motorist benefits. You should ask for a copy of the provision that excludes coverage for whomever was driving.

Sometimes insurance policies will exclude members of a household if they are not specifically named as an insured. Liability insurance policies cover any legal costs and payouts an insured party is responsible for if they are found legally liable. One should also check to see if the driver has a separate policy of insurance that would cover the accident.

Wests Encyclopedia of American Law edition 2. Social Studies 1 answer. In insurance policies the insured is not legally bound to any particular action in the insurance contract but the insurer is legally obligated to pay losses covered by the policy.

Reading your policy helps you verify that the policy meets your needs and that you understand your and the insurance companys responsibilities if a loss occurs. 8 Wall 168 19 L. In 1944 the high court held in.

The policy did not define a motor vehicle so the court looked to the statutes for guidance. In insurance policies the insured is not legally bound to any particular action in the insurance contract but the insurer is l egally obligated to pay losses covered by the policy. Policy and the parties to the insurance contract determine this during their contract negotiations1 The coverage will only extend to those entities identified or defined as insured parties under the terms of the policy2 Because the insurance company drafts the policy it bears the obligation to clearly identify who is covered and who.

Our policy is not to get involved where especially there is direct billing and all legal notices are made. The person who obtains or is otherwise covered by insurance on his or her health life or property. The insurance company denied benefits claiming that the bicycle did not qualify as a motor vehicle.

Get an answer to your question In insurance policies the insured is not legally bound to any particular action in the insurance contract but the insurer is legally obligated to pay losses covered by the policy. Copyright 2008 The Gale Group Inc. A life insurance contract promises to pay a specified amount of money to a designated beneficiary when the insured person.

Contract of adhesion d. Supreme Court in Paul v. When the applicant is the same as the person to be insured there is no question that insurable interest exists.

What contract element does this describe. What contract element does this describe. 357 1868 the issuing of an insurance policy did not constitute a commercial transaction.

In insurance policies the insured is not legally bound to any particular action in the insurance contract but the insurer is legally obligated to pay losses covered by the policy.

Third Party Bike Insurance Insurance Car Insurance Online Third Party

Ppt Topic 10 Legal Principles In Insurance Contracts Powerpoint Presentation Id 395956

Sample Contract For Wholesaling Flipping Houses Real Estate Investing Real Estate Investing Quotes Real Estate Contract Real Estate Investing Wholesaling

The Good The Bad Mortgage Protection Insurance Mpi Mortgage Protection Insurance Mortgage Affordable Life Insurance

Pin By The Project Artist On Understanding Entrepreneurship In 2022 Positivity Understanding Administration

Authorized Agreement Sample Template Templates Agreement Business Template

Ppt Topic 10 Legal Principles In Insurance Contracts Powerpoint Presentation Id 395956

Ppt Topic 10 Legal Principles In Insurance Contracts Powerpoint Presentation Id 395956

What Is Insurance Contract Law Times Journal

Proper Auto Coverage Risk Management Car Insurance Insurance Company

Exam Property And Casualty Mind Map Property And Casualty Insurance Sales Mind Map

Bundled Up Coverage In 2021 Life And Health Insurance Risk Management Home Insurance

Buy Home Insurance House Insurance Policy Which Will Protect Not Only Your Home But Also The Belon Buy Health Insurance Home Insurance Quotes Home Insurance

Auto Insurance Are You Exposed To Risk Car Insurance Auto Body Repair Car Insurance Tips

Personal Insurance Policy Personal Insurance Accident Insurance Person

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Comments

Post a Comment